There are many types of aid available to help you pay for the costs of tuition and fees at Florida Memorial University. Our Financial Aid Office will work hard to make sure you are informed about the many types of aid available to you and guide you through the process of securing financial assistance.

Grants: Undergraduate students who have not received a bachelor’s degree may be considered for the grant programs listed below. A current FAFSA is required.

Federal Pell Grant: This is a grant available to undergraduate students who demonstrate financial need based on the Federal Methodology Formula. Undergraduate students may receive a Pell Grant award up to $6,895 (2022-2023 academic year, divided evenly over two semesters for full-time enrollment) or $6,495 (2021-2022 academic year). The U.S. Department of Education determines student eligibility. No student will be eligible to receive more than 12 semesters or the equivalent of Federal Pell Grant funding.

Federal Supplemental Educational Opportunity Grant program (FSEOG): This is a grant available to undergraduate students who demonstrate exceptional financial need. This award is based on FMU’s annual funding which is limited. FSEOG is awarded to Pell eligible students and awards are made until the fund has been exhausted.

The Teacher Education Assistance for College and Higher Education (Teach) Grant Program: The TEACH grant is a federally funded program created by the College Cost Reduction and Access Act (CCRAA). The TEACH grant provides up to $4,000 a year in grant assistance to qualified students who plan to become a teacher and meet certain specified requirements. If a student who receives a TEACH grant does not complete the required teaching, the grant must be repaid as a Direct Unsubsidized Loan under the William D. Ford Federal Direct Loan Program.

Effective Access to Student Education Program (EASE): The William L. Boyd, IV, Effective Access to Student Education (EASE) Program is a state grant that provides tuition assistance to undergraduate student, degree-seeking, Florida residents attending an eligible private, nonprofit Florida college or university. The average EASE award for students for the 2021-2022 academic year was $2,841.

Florida Student Assistance Grant (FSAG): The Florida Student Assistance Grant (FSAG) Program is a need-based State grant program available to undergraduate, degree-seeking, Florida residents, that demonstrate substantial financial need and are enrolled in participating postsecondary institutions in the State of Florida. Based on the 2021-2022 academic year, the average award for FMU student was $2,600 for the academic year.

EASE AND FSAG – Initial Eligibility Requirements to Receive Funding

EASE AND FSAG Renewal Eligibility

For more information regarding EASE and FSAG, please visit the State of Florida websites:

Florida Memorial University Office of Admissions will review all new and transfer students for academic scholarship eligibility. If a student meets the criteria, the application is forwarded to the Scholarship Committee for review. Selected students are notified by the Office of Admissions. These scholarships are competitive and there are a limited number each year, based on funding. Students must have a valid, processed FAFSA before scholarships are disbursed.

Returning students are considered for need based and academic based awards based on funding. No additional application is needed. Students must meet SAP requirements for consideration, as outlined on our webpage.

Florida Memorial University is a member of the United Negro College Fund (UNCF). We encourage our students to visit www.uncf.org and create a profile, complete the general scholarship application, and apply for general and competitive scholarships. Good luck!

Other scholarship opportunities are sent weekly to student email addresses so please check your email for scholarship opportunities!

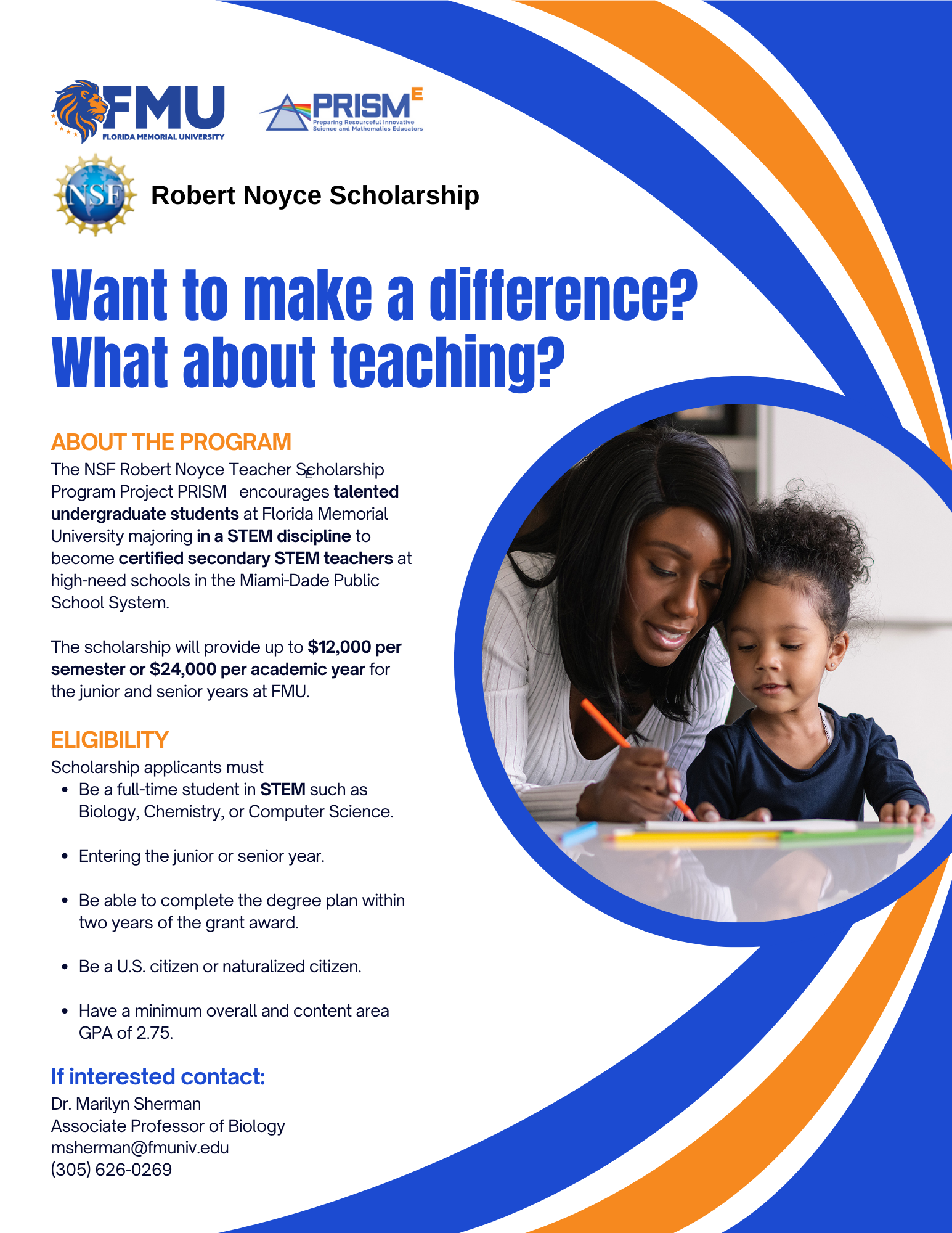

Noyce Scholarship for FMU students.

To apply for the Robert Noyce Scholarship click here and complete the application.

Please print and submit your completed form to Dr. Marilyn Sherman, Athalie Range Building, Lab 104.

Federal Direct Student Loans: Federal Direct student loans are a form of financial aid that must be repaid either after a student has graduated or when the student has stopped attending classes at least a half-time (6 credit hours). There are two types of Federal Stafford Student Loans: Subsidized and Unsubsidized. FMU also provides the Parent Loan for Undergraduate Students (PLUS) and a GRAD-PLUS loan for graduate students. ALL FIRST-TIME BORROWERS AT FMU MUST COMPLETE A MASTER PROMISSORY NOTE AND COMPLETE LOAN ENTRANCE COUNSELING AT www.studentaid.gov.

Subsidized Direct Loans are:

Federal Unsubsidized Stafford Loans:

Federal Direct Student Loan Eligibility Requirements

To be eligible for a Federal Stafford Student Loan, you must:

**All FMU** First-time borrowers must complete the Entrance Counseling https://studentaid.gov/entrance-counseling/ and the Master Promissory Note https://studentaid.gov/mpn/

Federal Parent PLUS Loan: The Federal student PLUS/Grad-PLUS loan can be borrowed by parents of dependent undergraduate students or graduate students to help pay for the student’s education. PLUS loans are typically less expensive than private student loans because PLUS loan borrowing terms are regulated by the U.S. Department of Education.

Direct PLUS Loans:

Federal Work-Study

FWS is a need-based financial aid program designed to assist students with employment opportunities on campus or within the community (when available). Students must be enrolled full-time (at least 12 credit hours) to maintain their eligibility for this program. This is a regular paid position in which a student will receive a bi-monthly paycheck. The FWS earnings are taxable; however, funds are excluded in the need calculation on the FAFSA.